The Rich Octopus Budget Sheet

In a world filled with ever-increasing expenses and financial uncertainties, budgeting has become an essential tool for achieving financial stability and success. The idea of budgeting may seem daunting to some, but the sooner you start budgeting, the sooner you can take control of your finances and work toward your financial goals. Today, we're here to inspire you to take that first step and embark on your unique budgeting journey.

Budgeting is not a one-size-fits-all solution. Just as every individual's financial situation is unique, so is their budgeting approach. Over the years, you'll discover what works best for you, your goals, and your lifestyle. And remember, your budget sheet is your financial canvas, waiting for you to paint it with the colors of your financial aspirations.

To help you on your budgeting journey, we're excited to share a

budget sheet that we've fine-tuned over the course of a decade. It’s a sheet that we still use today and are always looking to improve upon. Our budget template is meant to be a springboard for you to create a budget sheet that suits your individual needs and preferences, but feel free to use our template as is! See below on how you can begin.

Understanding the Budget Sheet

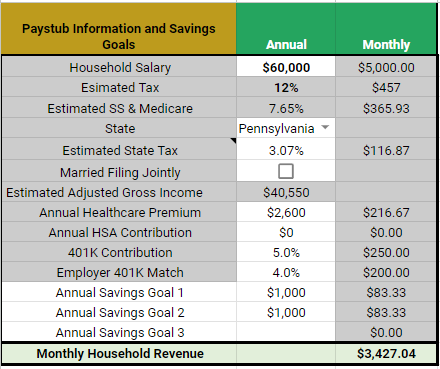

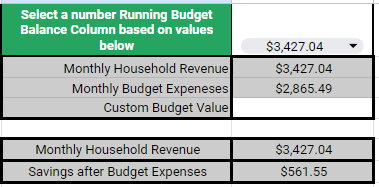

In the first sheet of this google worksheet, we have “Step 1: Set Your Budget”. Step 1 will help establish your monthly budget and project how much money you may owe in taxes. Please note, this calculator provides rough estimates. If you are looking for something more accurate, the IRS and SmartAsset are great resources to help determine if you are deducting enough for taxes.

We provided an example sheet for you to see how we are making our inputs. You will input your beginning balances in a separate sheet which will allow you to start your budgeting journey at any month of the year, whether it be mid April or beginning of January. In our example we will begin in April, but we highly recommend starting in January, so you can get a holistic view of your entire year via the Summary sheet. Let's begin!

Our Step-by-Step Guide on How to use this budget sheet:

Step 1. Set Your Budget

- Household Salary: Start by entering your total estimated annual household income. Include earnings from your full-time job, part-time work, and any side gigs. For example, let's say your full-time job pays $50,000 per year, and your part-time gig brings in an additional $10,000, making your total household income $60,000.00

- State: Choose your state to calculate a rough estimate of your personal taxes. You can also use an external link in the sheet for a more accurate analysis. For our example, we will use Pennsylvania.

- Married Filing Jointly: Check this box if you are married and plan to file your taxes jointly. For our example, we will leave it blank.

- Annual Healthcare Premium: Enter your annual healthcare cost. Check your pay stub to find out how much you pay monthly or bi-weekly, and then multiply it by 12 if you're paid monthly, 24 if paid twice a month, or 26 if paid every two weeks. In our example, let's assume our healthcare cost is $100 every two weeks, resulting in $2,600 annually.

- Annual HSA Contribution: If you have a high deductible plan, you may contribute to a Health Savings Account (HSA) at work. This account allows you to invest money that grows tax-free, but can only be used for healthcare expenses. For our example, let's assume we do not contribute to our HSA ($0).

- 401K Contribution %: Input the percentage you contribute to your 401K on a yearly basis. In our example, we contribute 5% to receive the full employer match of 4%.

- 401K Match Amount: This is the amount your employer contributes to your 401K account. Typically expressed as a percentage of your salary, it often requires you to contribute a certain percentage of your income to receive the employer match. The percentage may vary by employer. For our example, let's assume our employer contributes 100% of the first 4% and 50% of the next 2% of our contribution. To receive the full 4% match, we would need to contribute 5% of our salary. Therefore, we consider it a 4% match amount.

- Annual Savings Goal: If you have any savings goals for the year, input them here. In our example, we’ll have two savings goals.

- One is to have 1,000 at the end of the year to add to our general savings account

- Two is to have 1,000 to spend on vacation.

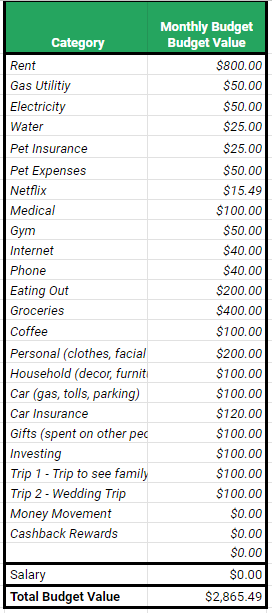

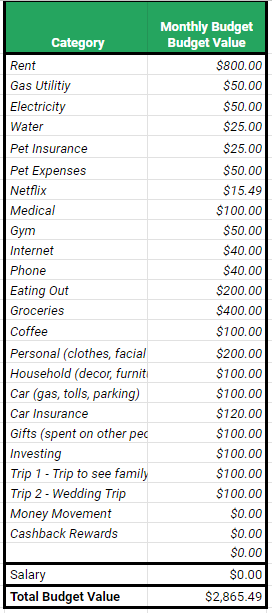

- Budget Item: List all of your yearly expenses and estimate their monthly costs. This table should cover all your expenses for the year, and it's recommended to be as detailed as possible (e.g., break down Utilities into Gas, Water, and Electricity). This detailed approach allows you to track changes or increases accurately. You can always add items later if needed.

- Salary: At the bottom of the table, input your estimated monthly salary. In our example, we estimated we are a single person, earning 60,000. The third table gives us an estimate of how much our monthly salary will be after taxes and deductions. We’ll go ahead and use that figure seen in cell I6.

- Select a number in the “Running Budget Balance Column”: Here, you can choose a running budget balance based on the values below, such as your monthly household revenue to track money going in, monthly budgeted expenses from your Budget Table, or a custom figure of your choice.

Congratulations! You've set up your yearly budget.

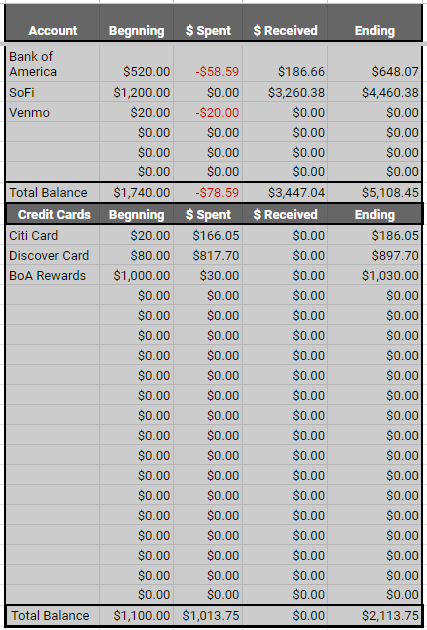

Step 2. List Your Accounts

List all your bank accounts, including Venmo, if you use it for storing money, along with their running balances.

Include your credit card accounts and input either the current balance or the statement balance you want to start tracking. If you're beginning your budget tracking today, input the current credit card balance and start tracking your expenses from here.

Step 3. Track Your Budget

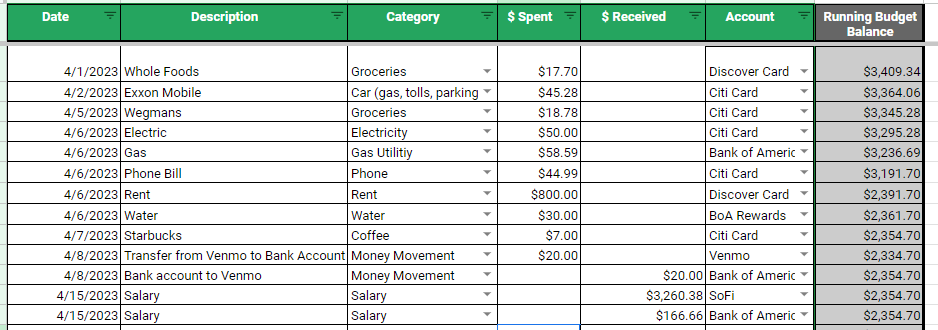

- Select the sheet that indicates the month that you are starting in. Our example, we started in April. Disregard all of the cells that are dark grey. Those will automatically get calculated as you input your numbers.

- The date of your expense.

- Input a description of your expense.

- Select a category that this expense falls under per the budget table that you created in Step 1.

- Don’t see a category that you want to start tracking? No worries! Go back to Step 1, add the category to your budget table, add a yearly budget amount for that category, and go back to the month you are working on. You can see that the category has been updated with your new item as well as any relevant values that may affect your overall yearly budget.

- If you’re paying a credit card, note that the category is automatically added to every credit card account you have.

- Input the money that you spent in the “$ Spent” column, including payments to your credit card. Select the bank account that this payment is coming from.

- If you receive money, input this amount in “$ Received”. Then select the account that the money is being deposited into.

- If you are moving money from one account to another, you can select the category, “Money Movement’. Be sure to input this transaction in two lines as “$ Spent” and “$ Received”.

- As an example, say we are moving a $20 balance from our Venmo account to our “Bank Account 1”. We will input the following:

- Date

- Description: Money movement from Venmo to bank,

- Category: “Money Movement”

- “$ Spent”: $20

- Account: Venmo

- Once the transactions show up in our bank account, we will input the same information, but for the bank:

- Date

- Description: Money movement from Venmo to Bank,

- Category: “Money Movement”

- “$ Received”: $20

- Account: Bank Account

- At the end of the year, this money movement account should be $0.00 to reflect the movement from accounts are really a $0 net loss/gain to you.

- Reconcile your accounts

- Make sure your credit card and bank statements match up to your monthly totals

- If they do not, determine how much you are off by and check to see what amounts are missing from either your spreadsheet or account.

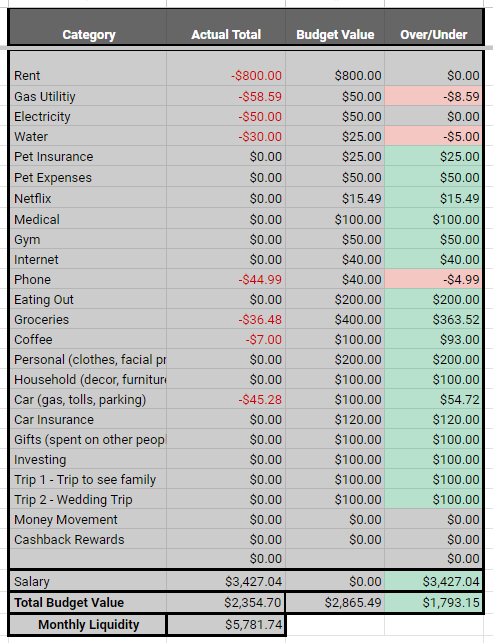

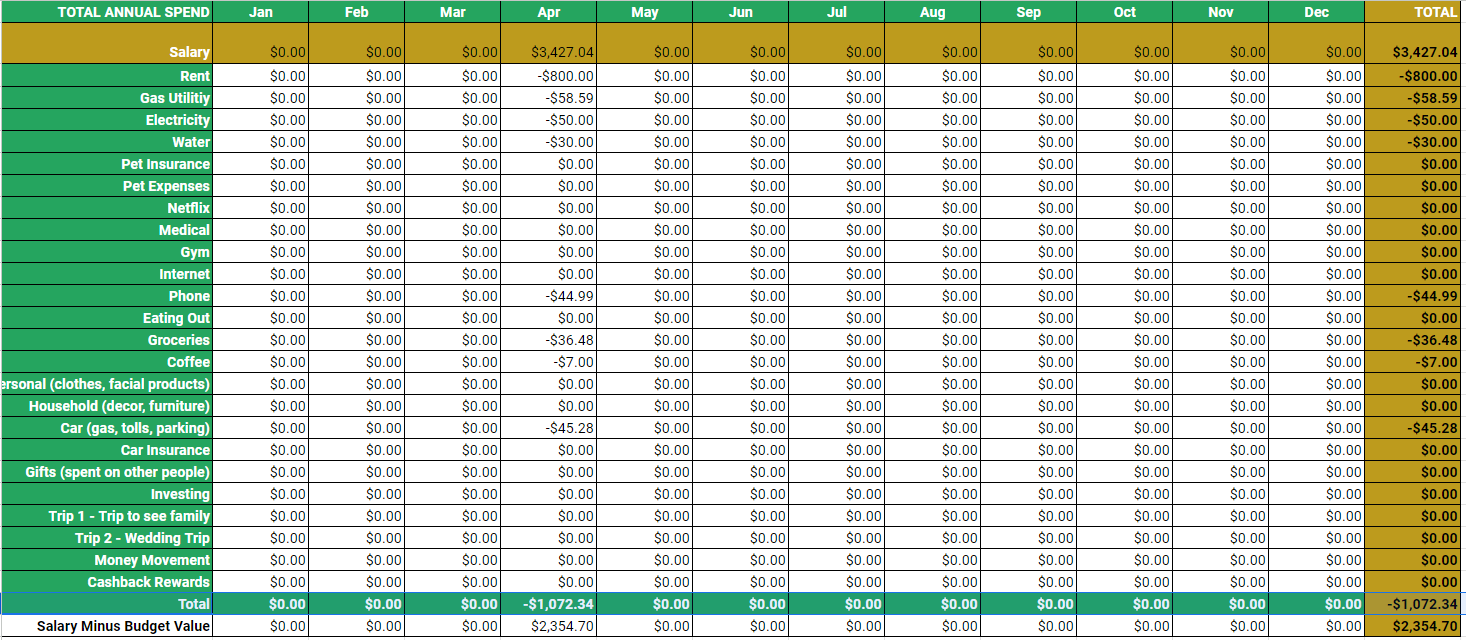

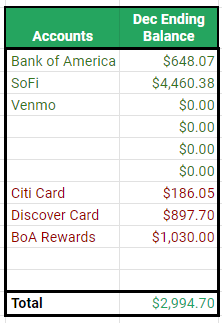

Step 4. Look at Your Monthly Summary and Overall Summary

The Summary Tab provides a cumulative view of your financial data throughout the year, offering an annual perspective of your overall budget as well as a current cumulative view of your account balances.

By following these steps and consistently tracking your expenses and income, you'll gain better control of your finances and work towards your financial goals. The key part is understanding where your money is coming from and where it is going.

Whether you're striving to save for a dream vacation, pay off student loans, or simply gain a better understanding of your spending habits, budgeting is the key to making those aspirations a reality. As we delve into the world of budgeting, remember that your journey is personal, and your budget sheet is a dynamic tool that adapts to your changing financial landscape. With commitment, patience, and a bit of creativity, you can craft a budget that not only keeps your finances in check but also empowers you to live the life you've always envisioned. So, let's begin this exciting journey toward financial freedom and security together.

Disclaimer: The provided spreadsheet is intended for informational purposes only and should not be solely relied upon for financial planning. It is an estimate based on projected and estimated variables and may not accurately reflect your specific financial situation. It is essential to consult with a qualified financial advisor or conduct comprehensive research to develop a comprehensive retirement plan tailored to your individual needs and circumstances. The spreadsheet serves as a tool to help you consider future planning and initiate discussions about your financial outlook.